United Arab Emirates, Dubai – 16 February 2022 – UAE-headquartered fintech business, Qashio has entered the MENA market on a strong note by raising USD 2.5 million in its pre-seed funding. Qashio’s enterprise-grade expense management platform enables business owners and finance leaders full visibility and control of all expenses.

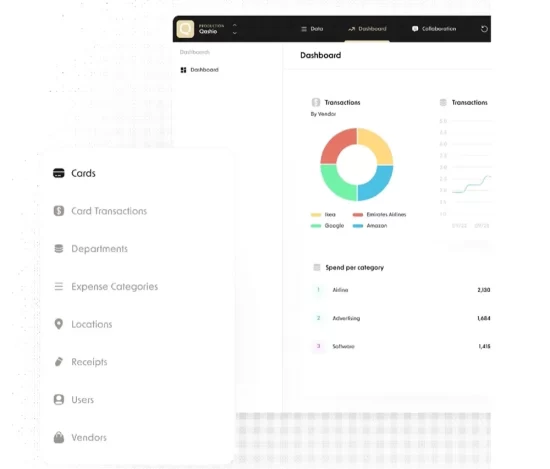

Their dashboard integrates real-time tracking for every business expense and allows and enterprises and SMEs to make informed cash flow decisions. The pre-seed funding round is led by global VC firm, MSA Novo (over $1.5bn AUM), and supported by Rally Cap Ventures, Palm Drive Capital, Plug and Play Ventures, as well as regional strategic angels, entrepreneurs, and family offices. Executives from Grubtech, Danske Bank, Two Sigma, Xiaomi, and top global fintech companies participated in the round as well

“Investing globally across b2b fintech platforms, we have monitored expense management players evolving across all major regions. Qashio is poised to be MENA’s breakout winner due to its founding team’s proven track record in building superior products and ability to execute in selling to enterprises. We are excited to partner with Qashio to impart best practices derived across other emerging tech markets.” said Seamon Chan, Palm Drive Capital.

Founded in 2021 by seasoned serial entrepreneurs Jonathan Lau and Armin Moradi, Qashio is a Fintech solution offering businesses a comprehensive enterprise expense management solution. Armin and Jonathan previously worked together while building Carriage, where they personally experienced the pain-point of expense tracking and management.

Qashio’s virtual cards combined with its software allows businesses to manage their spend in a more automated and transparent way, saving hundreds of man hours and reducing petty cash leakage in the process. Finance and HR departments benefit from better expense reporting, better visibility, control of cash flows and an empowered workforce.

Qashio has over 50+ customers, including Nana, Grubtech, Carasti & Swiss International Hotels. They have customers across UAE and KSA, and an expanding waitlist.

“Qashio’s software empowers us to have full control of our expenses and reduce our petty cash leakages. Integrating directly to our ERP system saves my finance team hundreds of hours as well!” – Abdulaziz Alshiha, CEO of Saudi Arabia’s Al Shiha Holding & Swiss International Hotels.

With Qashio, Business Owners, CFOs, HR Leaders and finance teams can set spend limits on virtual & physical cards issued in seconds, limit and control spend categories and vendors. This eliminates the use of cash, avoids late expense claims, reduces the amount of work put into reimbursements and ultimately replaces manual invoicing and vendor /supplier payment.

Jonathan Lau and Armin Moradi, co-founders of Qashio commented, “Businesses in the MENA region have been operating with limited ability to issue cards and manage employee expenses. At Qashio, we are committed to help companies move away from all those manual finance processes and get more visibility and control by providing a secure, safe solution that is ready for enterprise grade deployment as well as SMEs.”

“We are committed to have a clear, easy and fast onboarding processes for brands with no long-term commitments or heavy monthly service fees” – Armin Moradi, CEO, Qashio.

The launch of Qashio is in line with UAE’s vision for the next 50 years to accelerate world-class digitization and adoption of ICT across aspects of the business.

The FinTech sector in the Middle East is growing rapidly with a compounded annual growth rate (CAGR) of 30%. By 2023, it’s predicted that 800+ FinTech companies from sub-segments including payments, open banking, RegTech and compliance, smart lending, InsurTech, blockchain, and cybersecurity solutions for the financial industry (such as anti-money-laundering, anti-fraud, identity theft, identity management, and others) will raise over $2 billion in venture capital funding.

The funding will be used to expand the operations team and customer support, evolve the current features and integrations with additional fintech partners and rewards programs.

For more details on Qashio or for further advice on best practice spend management solutions visit www.qashio.com

About Qashio:

Qashio is a comprehensive spend management platform and financial control center for the MENA businesses that provides transparency on their corporate expenses and payments with software-enabled cards and all-inclusive accounts payable automation. With Qashio’s comprehensive software set and overall support brands can control their finances, reduce expenses as well as identify areas of cash overspend.