Dubai, United Arab Emirates — A toxic recession impeded global economic growth in 2022, as disadvantageous COVID-19 pandemic effects and the muddle of limited energy supplies were magnified by macropolitical uncertainty and red-hot inflation.

This led to skyrocketing oil & gas prices in Europe. The continent was hit hard, as much of its energy supplies are imported from Russia. Given current EU & USA-led sanctions, no Russian goods can flow to Europe among other restrictions.

Other regions were also impacted by inflation, including the United Arab Emirates. The nation witnessed the sharpest rise in prices in 36 months in December of 2021, and the heat isn’t cooling down.

UAE Inflation

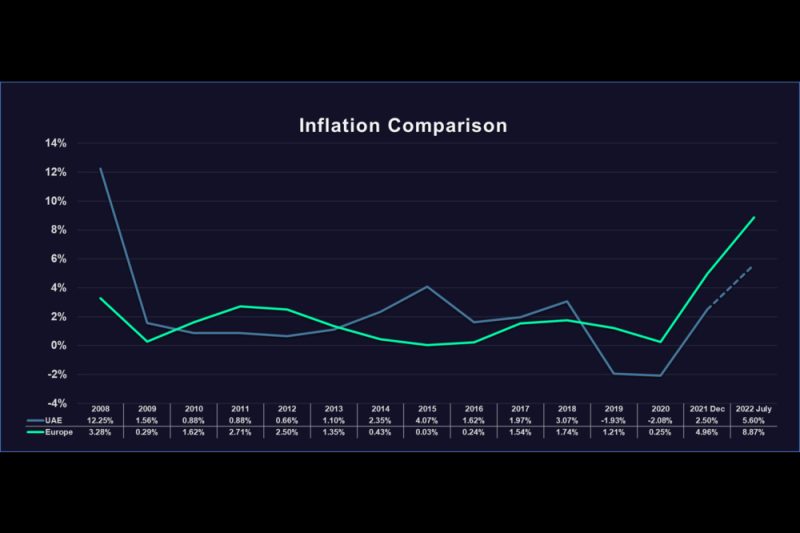

Over the past 12 years, the UAE’s inflation rate fluctuated between -2.1% and 12.3%, rising relentlessly after steep deflation. In November of 2021, inflation was at a 3-year high of 2.58%, but slid to 2.5% in December.

Central banks are aggressively hiking interest rates to cool-down inflation, and the UAE isn’t an exception. As its Dirham currency is pegged to the dollar greenback, the central bank bumped its interest rate by 75 basis points in July to 2.4%, in line with the Federal Reserve’s hike.

UAE expects annual inflation to hit 5.6% in 2022, meaning that a hasty recovery isn’t expected. Yet, current CPI figures are lower than anticipated, and significantly lower when compared to Europe or USA.

Europe Inflation

The eurozone witnessed a deteriorating euro, plummeting below the dollar for the first time in 20 years in July of 2022. Europe was plagued with rising prices of goods & services since 2021, especially energy resources. In June, Europe’s overall annual inflation hit 8.6%, which is a record high. It further-escalated to 8.9% the following month.

The European Central Bank (ECB) was reluctant to follow-suit and hike rates. This changed on July 21st when the ECB hiked rates for the first time in 11 years, doing so by a larger-than-expected 50 basis points to combat inflation.

For the remainder of 2022, inflation is expected to be extremely high throughout Europe. Inflationary pressures shall recede in 2023 but will continue to remain high at 4%, which is double the ECB’s desired figure of a mere 2%.

Analysis by Alpho